Make an Initial Plan

One of the main mistakes made by first-time entrepreneurs is the lack of planning when conducting the business. Then comes also the financial planning. Structuring early on what can be spent in a year, for example on items such as equipment, staff, marketing, and others will help you define other items. Along with spending, it is necessary to define working capital, the investments to be made, the expected profits and how to raise this external capital.

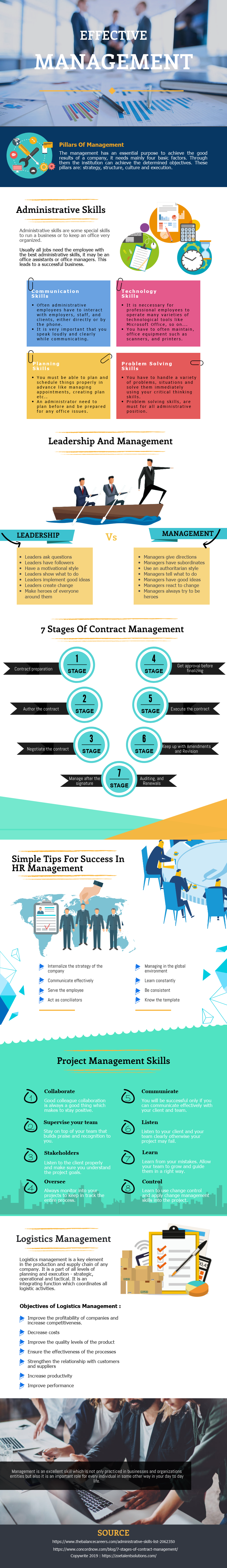

Zoetalentsolutions.com will help you to know more information about the management process in business organizations and also it is very useful for first-time entrepreneurs.

Financial planning at hand, the administration takes place without improvisation or setbacks. Just follow your plan, adjusting it when necessary, so you can use your money wisely and make a note of each transaction.

Don’t Lose Control of Working Capital

One of the biggest villains that bankrupt small and medium businesses is the lack of working capital, which is the reserve that ensures that activities continue at the most critical times. And this is true even when the company has been making a profit because the revenue is always variable and it may be that the next months are not as full as the last. Thus, this money should always be monitored and well managed.

Focus on Cash Flow

Another point that should be given special attention is the company’s cash flow because it is through it that you can know how much money goes in and out of total transactions.

By knowing your cash flow well, you can know where your company’s break-even point is, so you can better manage your payables and receivables by charging customers owed and asking for more time or favorable conditions for suppliers.

Separate Management of Company Money from Your Personal Account

It is very important for the entrepreneur to distinguish the accounts, as the frequent withdrawal of cash from the company can greatly damage its financial health. An important step in creating this separation is to define the partners’ pro-labor, that is, their salary in the company.

Remember that pro-labor only exists when the partner works in the company. Where this is not the case and the partner acts solely as an investor, a distribution of the profits shall be made. However, it is very important to remember that not all profits must be shared among the partners because a part must be reinvested in the company for it to develop and grow.

Beware of Stock

Many people see product inventory as a cost, but it should be seen as an investment. It is the money of the company converted into goods and needs different treatment to avoid unnecessary expenses.

When managing this investment it is important to know what your market demand is without being overly pessimistic or overly optimistic. In addition, you must have a safety margin if unexpected demand growth arises.

Administer with the Help of an Online System

Managing by gathering paperwork or Excel spreadsheets is not practical and error-prone. Thus, a valuable management tip is to use proprietary software that can be accessed from anywhere, with information stored in the cloud and constantly updated in an integrated manner. Thus, the numbers are correct and help to get uncomplicated once and for all.